Recurring billing models have become a key driver of sustainable revenue growth across industries. But recurring billing is not a new concept. Traditional examples include newspaper and magazine subscriptions, utility bill payments, and tuition fees. However, the digital economy has transformed the way businesses leverage recurring billing, making it a core strategy for SaaS, media, entertainment, e-learning, and more.

In this article, we’ll explore the fundamentals of recurring billing, why businesses should consider it, and how to implement it effectively.

What is recurring billing?

Recurring billing refers to a payment model where businesses automatically charge customers at regular intervals for ongoing access to a product or service. Customers provide their payment details once and authorize merchants to charge them at a set frequency—monthly, quarterly, or annually.

This model is widely used across industries, from SaaS platforms to insurance policies and digital subscription services.

Fixed vs. variable recurring billing

Recurring charges can be both fixed and variable.

- Fixed Recurring Billing: Customers pay a consistent fee at regular intervals (e.g., Netflix or Spotify subscriptions).

- Variable Recurring Billing: Charges fluctuate based on usage (e.g., cloud storage fees or pay-as-you-go mobile plans).

Do the "recurring payment model" and "recurring subscription billing model" mean the same?

The recurring payment model closely resembles the recurring subscription billing model, and they're often used interchangeably. They’re similar in the sense that they both support automated, periodic payments and share the customers' payment information.

However, there is a significant difference between the two.

- Recurring payments involve automated, periodic charges for a set price (e.g., insurance premiums).

- Subscription billing offers more flexibility, allowing users to change plans, upgrade, or downgrade.

Subscription billing is the most common form of recurring billing because it provides opportunities for upselling and cross-selling, enhancing customer lifetime value (CLV).

Why is recurring billing so popular?

Businesses are increasingly adopting recurring billing due to its predictability, customer retention benefits, and revenue expansion potential.

1. Predictable cash flow:

Recurring billing ensures a stable and predictable revenue stream, helping businesses plan budgets, allocate resources, and improve return on investment (ROI).

2. Increased customer lifetime value (CLV)

Reducing churn is essential for profitability. Acquiring new customers is expensive, but retaining existing customers through seamless billing increases profitability. Subscription billing also minimizes involuntary churn—cases where customers lose access due to expired or failed payments. Learn more about customer lifetime value.

3. Revenue growth through tiered pricing

Recurring billing enables businesses to offer multiple pricing plans and encourage customers to upgrade, adding revenue through:

- Upselling (moving to a higher-tier plan)

- Cross-selling (adding complementary services or features)

4. Reduced payment failures and administrative effort

Automated billing systems minimize late payments, reducing the administrative burden on finance teams. Specialized billing tools also help businesses proactively manage failed payments and dunning processes to recover lost revenue.

5. Greater customer satisfaction

Recurring charge models enable merchants to offer discounts to their different customer segments for longer commitments due to decreased customer acquisition costs. This often ends up contributing to greater customer satisfaction and loyalty.

6. Decreased incidence of late payments

Automated recurring billing also helps merchants to save resources in terms of time and money to track late payments. This provides greater room to focus on growing the core business instead of being caught up in long-winded administrative tasks.

How to implement recurring billing

Setting up a successful recurring billing system requires clear pricing structures, a robust payment processing system, and automation tools.

1. Define your pricing plans

Establish the billing frequency (monthly, quarterly, annual) and pricing structure (fixed, tiered, or usage-based).

2. Payment authorization and capture

The payment process typically follows two key steps:

-

Payment Authorization:

- The merchant sends a payment request to the payment acquirer (e.g., Stripe, PayPal).

- The acquirer checks the customer’s account for sufficient funds and places an authorization hold.

- If successful, an authorization code is sent back for approval.

-

Payment Capture:

- The authorized amount is deducted, and the merchant receives the funds.

Some billing systems streamline this into a single-step direct charge process, but multi-step authorization is more common.

3. Choose a subscription billing platform

A specialized subscription billing platform simplifies the process, ensuring seamless recurring payments, tax compliance, and fraud prevention.

Implementing recurring billing for D2C subscription businesses

For digital subscription businesses, Cleeng provides an advanced recurring billing and payment management platform called Merchant.

Merchant helps businesses:

- Automate billing, tax compliance, and fraud detection and prevention. Learn more about digital subscription tax.

- Reduce involuntary churn with smart dunning strategies

- Offer flexible pricing structures and optimize checkout flows

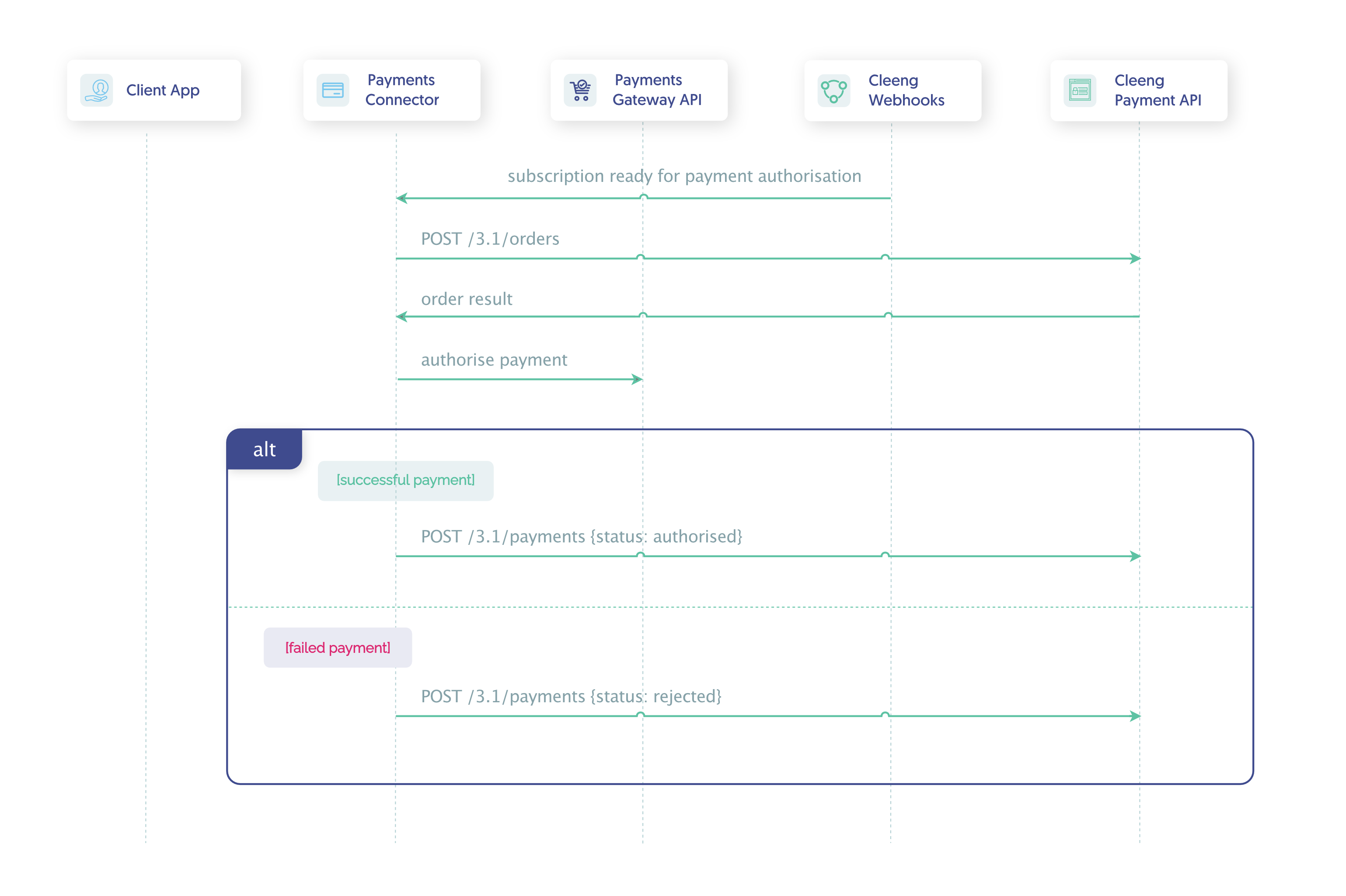

Cleeng supports two integration methods for managing recurring billing:

- Split, Authorize & Charge Integration (Two-step process: authorization + capture)

- Basic Direct Charge Integration (One-step capture without authorization)

Both options require webhook configurations and proper dunning workflows to maximize revenue recovery and minimize payment failures.

See a visualisation of the payment authorisation payment flow below:

Read More: Step-by-step guide for implementing Cleeng-managed recurring billing.

Recurring billing is a powerful model for driving predictable revenue and increasing customer retention. Businesses that implement it effectively benefit from greater financial stability, higher CLV, and lower administrative costs.

If you’re looking for a robust billing solution tailored for subscription businesses, Cleeng Merchant simplifies the process with automation, analytics, and compliance features. Contact us today!

Wish to enable a secure, dependable framework for simplified recurring billing?